Running a dropshipping store can feel like a rollercoaster.

One day, you’re making sales, the next, your ad costs jump, and suddenly, you wonder if you’re even making money.

The simple truth is: you can’t grow a profitable store if you don’t know your break-even point.

And in this guide, we’ll break it down step-by-step.

Let’s start, because guessing is for gamblers, but you’re here to build a business.

What is a break-even point in dropshipping?

Imagine you’re running your store and making sales.

Money is coming in, but money is also going out.

You’re paying for your products, shipping, ads, your Shopify plan, maybe a few apps, and payment processing fees.

Your break-even point is the moment when the money coming in from sales exactly matches the money going out to cover all those costs.

At that point, you’re not making a profit, but you’re not losing money either:

When we talk about break-even, you can look at it in two ways:

- Break-even in units → How many products do you need to sell to cover your costs?

- Break-even in revenue → How much money you need to make in sales to cover your costs.

Both are useful.

Units give your marketing team a clear “sales goal,” and revenue gives your store a big-picture financial target.

Why should you analyse your break-even point?

Your break-even point tells you exactly when you’re break-even, when you’re growing, and when you’re losing money.

When you’re starting, analysing your break-even point gives you:

- Clarity → You’ll know the exact number of sales you need to survive each month.

- Confidence in pricing → You can create pricing strategies that actually make sense instead of guessing.

And once you’re past the beginner stage, a break-even analysis becomes a powerful tool for scaling smarter.

For example, you can calculate your break-even ROAS (Return on Ad Spend) and set ROAS targets so you instantly know whether an ad campaign is worth scaling:

Break-even point formulas for dropshippers

Okay, now we’re getting into the good stuff.

Knowing what a break-even point is is important, but knowing how to calculate it is where the magic happens.

The formula you use will depend on whether you want your break-even point in units (how many products you need to sell) or in revenue (how much money you need to bring in).

So, let’s break down both:

Break-even point in units

If you want to know how many products you need to sell each month to cover your costs, here’s the formula:

Break-even units = Fixed costs / (Selling price per unit – Variable cost per unit)

- Fixed costs → Costs that stay the same no matter how many sales you make (e.g., Shopify plan, domain, monthly app subscriptions).

- Selling price per unit → The price your customer pays for one product.

- Variable cost per unit → Costs that change depending on sales volume (e.g., product cost, shipping, payment processing fees).

In simple words:

Take your monthly fixed costs and divide them by how much profit you make per sale after covering your variable costs. That’s how many units you must sell just to break even.

Note: Don’t worry if this looks complicated right now. I’ll show you some practical examples in a moment!

Break-even point in revenue

If you want to know how much money in total sales you need to cover your costs, use this formula:

Break-even revenue = Fixed costs / Contribution margin ratio

Where:

Contribution margin ratio = (Selling price – Variable cost) / Selling price

The contribution margin ratio gives you the percentage of each sale that’s profit before covering fixed costs. Once you know that percentage, you can calculate exactly how much sales revenue you need to hit break-even.

Pro tip: Break-even ROAS

If you run paid ads, this metric is essential to know:

Break-even ROAS = Selling price / (Selling price – Variable cost excluding ad cost)

What it means:

- ROAS (Return on Ad Spend) tells you how much revenue you earn for every dollar you spend on ads.

- Your break-even ROAS is the minimum ROAS you can have without losing money.

- If your ad set’s ROAS is lower than your break-even ROAS, you’re losing money. If it’s higher, you’re making a profit.

These formulas might look intimidating at first, but once you plug in your real numbers, you’ll see just how powerful they are!

Step-by-step example (units)

It’s time to apply the formulas and see exactly how they work in practice.

We will start by calculating how many units you need to sell each month to break even.

This is your survival number, the bare minimum you must sell just to cover your costs.

Let’s imagine you’re selling fitness water bottles and these are your numbers:

- Selling price: $30

- Product cost from supplier: $15

- Payment processing fee: 3% per sale = $0.90 per unit

- Fixed costs (monthly): $300 (Shopify plan, apps, domain, etc.)

- We’re not including ad costs here yet; we’ll handle that in the next section.

Step 1: Calculate variable cost per unit

Your variable cost is everything you spend for each unit sold.

For our water bottle:

- Product cost = $15

- Payment fee = $0.90

Variable cost per unit = $15 + $0.90 = $15.90

Step 2: Find your contribution margin per unit

Contribution margin per unit = Selling price − Variable cost per unit = $30 − $15.90 = $14.10

This means every bottle sold leaves you with $14.10 to pay for your fixed costs.

Step 3: Apply the break-even units formula

Break-even units = Fixed costs / (Contribution margin per unit) = $300 / $14.10 = 21.28

Step 4: Interpret the result

You can’t sell 0.28 of a bottle, so you round up: You must sell at least 22 bottles per month just to cover your fixed costs.

Anything below 22 units → you’re losing money.

Anything above 22 units → you’re in profit (before ads).

Step-by-step example (revenue)

Now, let’s look at the same situation from a different angle: How much total sales revenue do you need to cover your costs?

Sometimes this view is easier to track, especially if you’re looking at your Shopify dashboard or ad manager, where revenue is front and center.

Step 1: Calculate the variable cost per unit

We already did this in the last example:

Variable cost per unit = $15 (product) + $0.90 (payment fee) = $15.90

Step 2: Calculate the contribution margin ratio

The Contribution Margin Ratio (CMR) shows what percentage of each sale is profit before covering fixed costs:

CMR = (Selling price – Variable cost) / Selling price = ($30 – $15.90) / $30 = 0.47

So, 47% of each sale goes towards covering fixed costs and profit.

Step 3: Apply the break-even revenue formula

Break-even revenue = Fixed costs / CMR = $300 / 0.47 = $638.30

Step 4: Interpret the result

You need about $639 in sales revenue per month to break even.

That means:

- If your store earns less than $639 in a month → you’re losing money.

- If your store earns more than $639 → you’re profitable (before considering ad costs).

Tip: Want an even more detailed calculation of your profit? Check out our profit margin calculator here:

Step-by-step example (ROAS)

If you’re running paid ads, knowing your break-even ROAS is like having a “yes/no” light for your campaigns.

It tells you the minimum Return on Ad Spend you can have without losing money.

ROAS is calculated as:

ROAS = Revenue from ads / Ad spend

Your break-even ROAS strips it down to the bare survival level. Anything higher means profit, anything lower means a loss.

Step 1: Apply the break-even ROAS formula

Break-even ROAS = Selling price / (Selling price – Variable cost) = $30 / ($30 – $15.90) = 2.13

Step 2: Interpret the result

Your break-even ROAS is 2.13.

This means: for every $1 you spend on ads, you must earn at least $2.13 in revenue just to avoid losing money.

- ROAS higher than 2.13 → profitable.

- ROAS lower than 2.13 → you’re losing money on ads (before fixed costs).

Including advertising costs in the equation

Up until now, our examples have looked at break-even without including advertising costs.

That’s fine if you’re calculating pure product profitability… but with dropshipping, ads are usually your biggest expense.

If you don’t include them, your break-even point might look great on paper, while your bank account is quietly bleeding.

The simple approach (beginner-friendly)

If you just want a quick, safe way to include ads in your break-even calculation, treat ad cost per sale as part of your variable costs.

You do this by calculating your average CPA (Cost Per Acquisition).

This is the average amount you spend on ads to get one sale.

Example: If you spent $500 on ads and made 50 sales:

CPA = $500 / 50 = $10

If your variable cost (product, shipping, payment fees) is $15.90, and your CPA is $10:

New variable cost = $15.90 + $10 = $25.90

Now, plug this new variable cost into the formulas for break-even units or revenue, and your results will reflect ad spend too!

The smarter approach (for ad optimization)

When you’re actively running campaigns, Break-Even ROAS is a fast way to see if a campaign is losing or making money.

It answers whether you’re making enough per sale to pay for the product and the ad that brought the customer in.

From our earlier example, we saw that the break-even ROAS is 2.13.

This means:

- If your ad set’s ROAS is above 2.13, each sale is covering its own product cost + the ad cost.

- If your ROAS is below 2.13, you’re losing money on each sale.

But here’s the catch:

Break-even ROAS does not mean you’re overall profitable, because it ignores fixed costs like your Shopify plan, apps, or other monthly expenses.

For example, if you only make 10 sales a month at a ROAS of 3.0:

- Those 10 sales cover the product cost and its ad cost.

- You’re profiting $30 * 10 – ($30 / 3.0) * 10 – $15.90 * 10 = $41

- But if your fixed costs are $300/month, you’re still $259 in the red.

That’s why you need two break-even checks:

- Break-even ROAS → Use it for quick, in-platform ad decisions.

- Break-even Units/Revenue → Use it to see if you’re truly profitable after covering everything.

5 Common mistakes when calculating break-even

Calculating your break-even point isn’t rocket science, but it’s easy to get it wrong in ways that can quietly destroy your margins.

Here are the most common mistakes I see dropshippers make:

It’s not just product cost and shipping.

You also need to factor in:

Great read: How to Save Fees When Dropshipping in 2025 (8 Great Tips)

2. Using unrealistic ad costs

If you’re still testing, it’s tempting to include a “dream” CPA or ROAS number in your formula.

But your real costs will likely be higher, especially during the first few weeks of ads.

So, start with conservative estimates based on actual early data, then update your break-even numbers regularly as performance improves.

3. Not updating calculations

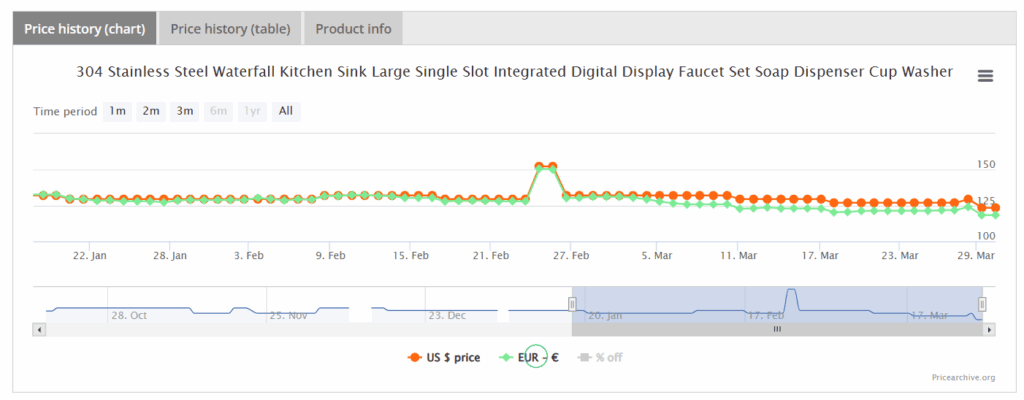

Your supplier might increase prices, your shipping costs might go up, or your payment processor might change their fee structure.

If you don’t update your break-even point after these changes, you will make decisions with outdated numbers.

4. Ignoring product-by-product differences

If you sell multiple products, each one has its own costs and margins.

And in that case, using a single store-wide break-even point can hide unprofitable products.

It’s better to calculate break-even for each SKU, then decide whether to keep, reprice, or kill low-margin products.

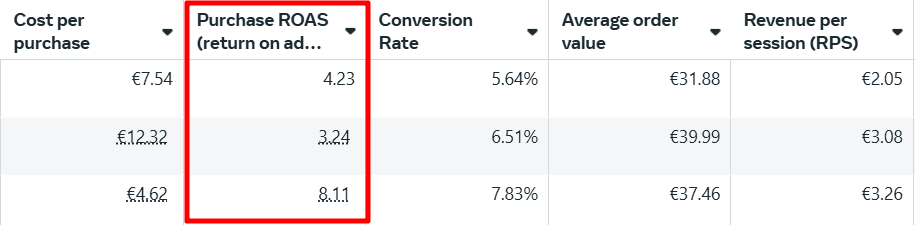

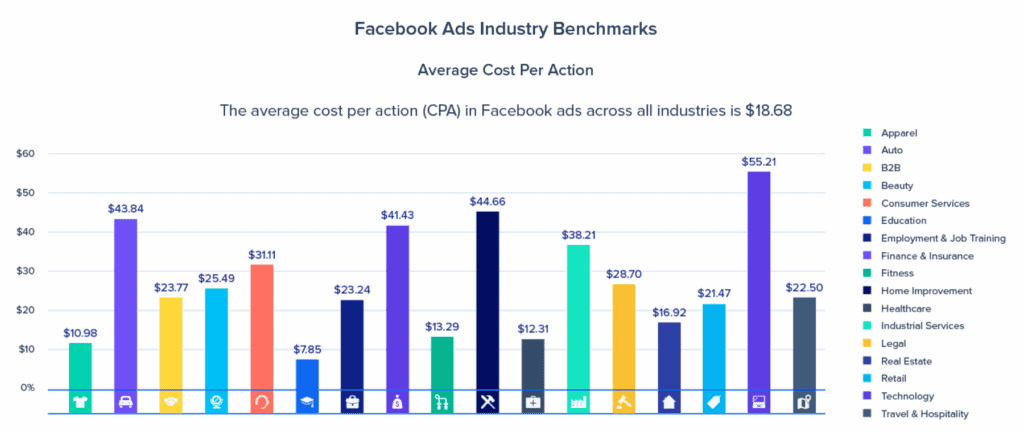

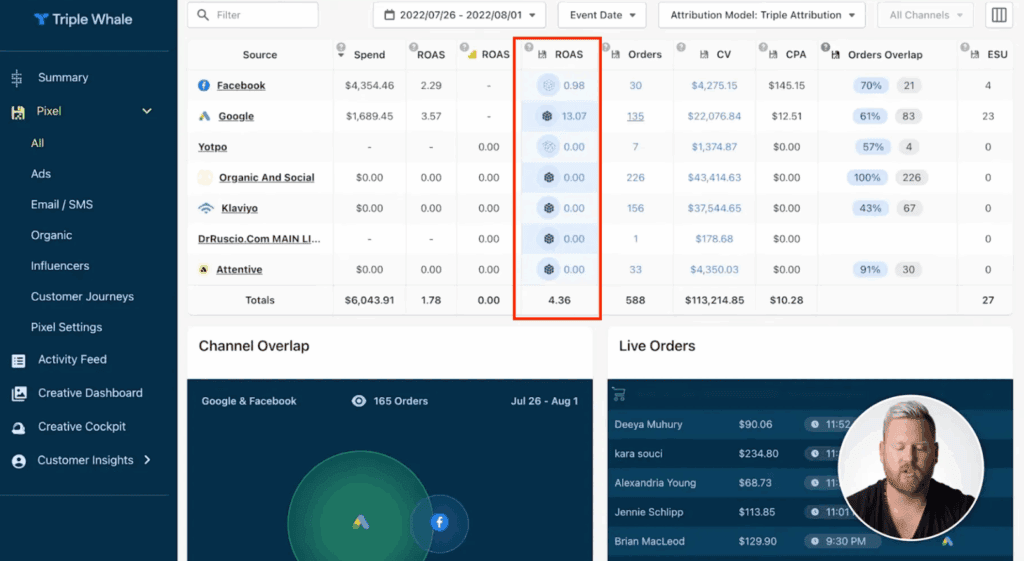

5. Forgetting to separate traffic sources

Different ad platforms have different costs and conversion rates.

And, if you mix them all together, you can’t see which channels are truly profitable.

To fix it, track break-even CPA or ROAS separately for Facebook, TikTok, Google, email, etc:

This way, you know where to push the budget and where to cut back.

Summary

Before we go, we’ve created a quick summary of this article for you, so you can easily remember it:

- Running a dropshipping store without knowing your break-even point means you are guessing whether you are making money or losing it.

- The break-even point is when your sales revenue exactly matches your total costs, resulting in no profit and no loss.

- There are two main ways to view break-even: in units, which tells you how many products you need to sell, and in revenue, which tells you how much sales money you need to generate.

- The most common mistakes dropshippers make when calculating break-even include forgetting hidden costs, using unrealistic ad costs, not updating calculations, ignoring product differences, and mixing traffic sources.

- Your break-even point is a living metric that should be updated regularly and used as both a safety net and a guide for growth.

Conclusion

If you’ve made it this far, you now know more about break-even points than most dropshippers ever will.

You understand what it is, why it matters, how to calculate it in units, revenue, and ROAS, and, most importantly, how to actually use it to make smarter business decisions.

Good luck with everything!

Want to learn more about dropshipping?

Ready to move your dropshipping store to the next level? Check out the articles below:

Plus, don’t forget to check out our in-depth guide on how to start dropshipping here!