Selling to EU customers means dealing with VAT, and for ecommerce sellers, it is not optional.

But figuring out when and how to charge VAT for cross-border dropshipping can feel like solving a puzzle with missing pieces.

That’s where the IOSS (Import One-Stop Shop) and OSS (One-Stop Shop) systems come in!

These EU tax frameworks are designed to simplify VAT for ecommerce sellers, but choosing the right one depends on how you operate.

Quick Answer: How does IOSS and OSS help with cross-border VAT for EU dropshipping?

IOSS and OSS simplify EU VAT compliance for dropshippers. Use IOSS for B2C imports into the EU under €150 to charge VAT at checkout and avoid customs delays.

Use OSS for intra-EU B2C sales to file one quarterly return across countries. Together, they reduce registrations, speed delivery, and prevent VAT errors.

We spent dozens of hours researching real-world VAT scenarios, reviewing official EU tax guidelines, and analyzing the most common dropshipping setups.

This guide explains exactly how IOSS and OSS work, when you need them, and how to avoid common VAT mistakes when selling across the EU.

Let’s get started!

What is VAT and how does it work in the EU?

Before we talk about IOSS and OSS, let’s make sure you fully understand what VAT actually is.

VAT stands for Value Added Tax. It’s a type of sales tax that is added at each stage of a product’s journey, from manufacturing to final sale. In the EU, it’s charged on most goods and services.

If you’re selling to customers in the EU, you almost always need to include VAT in your prices and pay it to the correct EU country.

Here’s a simple example:

- You sell a product for €120 to a customer in France.

- France’s VAT rate is 20%.

- That means you collect €120 – (€120/1.20) = €20 VAT from the customer.

- You must send that €20 to the French tax office.

Easy enough, right? But things get more complicated when:

And that’s where many dropshippers run into problems.

Important: Each EU country has its own VAT rate, and you must apply the correct one based on your customer’s location.

As of 2025, EU standard VAT rates range from 17% (Luxembourg) to 27% (Hungary):

| Country | Standard VAT rate |

| Luxembourg | 17% (lowest) |

| Germany | 19% |

| France | 20% |

| Netherlands | 21% |

| Sweden | 25% |

| Hungary | 27% (highest) |

So, if you’re selling to customers in different countries, you need to know which rate applies based on their location.

Once you know the VAT rate, you need to determine where and how to pay it, especially if you’re selling across borders.

That’s exactly what the IOSS and OSS systems were built for.

How the EU VAT rules have changed (IOSS & OSS introduction)

Before 2021, if you sold to multiple EU countries, you often had to register for VAT in each country, file multiple VAT returns, and keep track of complex local rules.

Imagine this: You’re based in Spain, but you’re selling to customers in Germany, Italy, and France.

Under the old rules, once your sales in each country passed a certain limit (called a distance selling threshold), you had to:

- Register for VAT in each country

- File separate VAT returns

- Understand local tax rules (in different languages!)

Small sellers had to register for VAT in multiple countries, file local returns, and manually manage foreign tax rules.

That’s why the EU created IOSS and OSS in July 2021, to fix the complexity of multi-country VAT compliance for ecommerce sellers

And it worked!

With IOSS and OSS, sellers now have a much easier way to manage VAT when selling to customers in different EU countries.

By the end of 2024, over 170,000 businesses had registered under the EU’s OSS/IOSS frameworks.

Here is a quick overview of the two before we dive deeper into both of them:

| Feature | IOSS (Import One-Stop Shop) | OSS (One-Stop Shop) |

| Applies to | B2C imports into the EU | Sales within the EU (cross-border) |

| Product value limit | ≤ €150 per consignment (intrinsic value) | No shipment limit (separate €10k annual threshold for place-of-supply) |

| VAT charged | At checkout (customer’s VAT rate) | At checkout (customer’s VAT rate) |

| Reporting frequency | Monthly | Quarterly |

| Customs simplification | Yes (IOSS number → faster clearance) | Not applicable (OSS doesn’t cover imports) |

| Who can register | EU & non-EU (non-EU usually need an EU intermediary, except where EU has a VAT mutual-assistance pact, e.g., Norway) | EU & non-EU (Learn here what applies to you) |

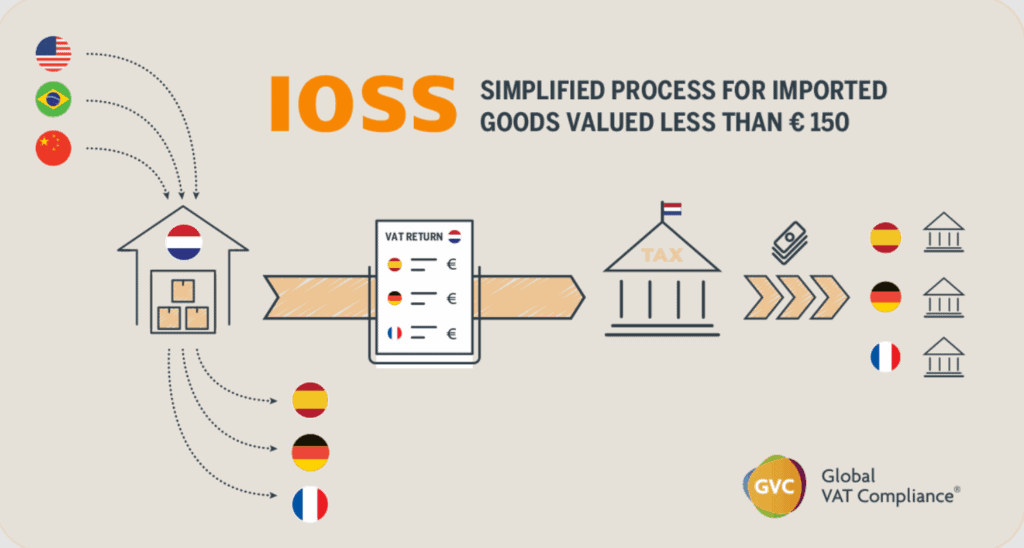

What is IOSS (Import One-Stop Shop), and when do you need it?

If you’re dropshipping products from outside the EU (for example, from China), IOSS is the VAT system you’ll likely need.

IOSS (Import One-Stop Shop) is a special VAT system for goods imported into the EU that are:

- Worth €150 or less per order (excluding shipping and insurance).

- Sold directly to EU consumers (B2C).

- Shipped from outside the EU.

Instead of customers paying VAT at the border (which often causes delays and surprise fees), you collect the VAT at checkout and then report it through your IOSS number in one monthly return.

With IOSS, you get:

- Faster delivery. Using IOSS speeds up customs clearance because VAT is pre-collected and validated at import, which carriers note leads to faster transit times.

- Happier customers. No unexpected VAT bills or handling fees when the package arrives.

- Simpler reporting. You declare all your EU import sales in one place.

- A level playing field. Non-EU sellers compete fairly with EU sellers, since VAT is always included.

Example of how IOSS works

Let’s say you sell a phone case from China to a customer in France.

- Product price: €10

- French VAT rate: 20%

- Customer pays: €12 (price + VAT)

You collect the €2 VAT at checkout. At the end of the month, you report that VAT in your IOSS return and pay it to the French tax authority through your IOSS number.

The package arrives in France, customs checks the IOSS number, and the parcel is delivered directly to the customer.

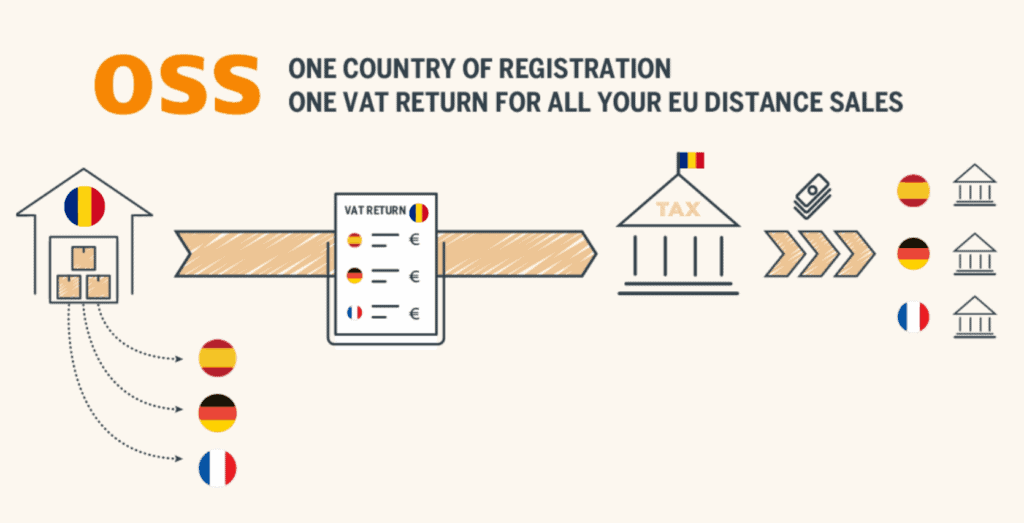

What is OSS (One-Stop Shop), and how does it help with intra-EU sales?

If IOSS is for imports into the EU, then OSS is for sales that happen within the EU.

So, if your dropshipping supplier is EU-based and you’re selling to customers in other EU countries, then OSS is the tool you need.

With OSS, you can:

- Register for VAT in just one EU country.

- File one quarterly VAT return that covers all your EU cross-border sales.

- Pay the VAT you have collected, and the tax office in your home country will distribute it to the other EU countries on your behalf.

Easy, right?

Example of how OSS works

Let’s say you’re a seller based in Germany. You store stock in a German warehouse and ship to customers across the EU.

- You sell €500 worth of products to customers in France (VAT rate 20%)

- You sell €1,000 worth of products to customers in Italy (VAT rate 22%)

- You sell €800 worth of products to customers in Sweden (VAT rate 25%)

Instead of registering for VAT in France, Italy, and Sweden, you simply report these sales in your OSS return through the German tax authority.

Then, Germany’s tax office automatically forwards the VAT to each country.

Which VAT scheme applies to your dropshipping business?

Still unsure which system you need?

It depends on your supplier location and where your customers live. Let’s walk through the most common scenarios for dropshippers:

1. Dropshipping from outside the EU (e.g., China) to the EU

This is the classic dropshipping model. You take an order from a customer in the EU and your supplier in China ships the product straight to them.

If the order is worth €150 or less, you can use IOSS to:

- Collect VAT at checkout

- Avoid customs delays

- Keep your customers happy (no surprise fees)

Note: If you’re not based in the EU, you must register for IOSS through an EU-based intermediary.

2. Dropshipping from an EU supplier to other EU countries

This is a common setup in 2025 for dropshippers targeting the EU market.

Instead of importing products from outside the EU, you work with a European supplier like Hertwill.

This supplier is based in the EU and ships directly to your customer when an order comes in.

Here’s how it works:

- You buy the product from Hertwill at a wholesale (B2B) price, usually without VAT (if you’re VAT registered).

- You sell the product to an EU consumer (B2C) via your own store.

- Hertwill ships the product from within the EU, so there are no import taxes or customs delays.

- You collect the payment and issue the invoice to the customer.

Since you’re responsible for the final sale, and your customers are located in multiple EU countries, you must:

- Register for VAT in your home country.

- Register for the OSS (One-Stop Shop) scheme.

- Charge the correct VAT rate based on the customer’s location.

- Report all cross-border sales in one simple OSS return each quarter.

Example

You’re based in Estonia, using Hertwill as your EU supplier:

A customer in France buys a product from your store for €50.

- You buy the product from Hertwill for €25 (VAT-free, B2B).

- You charge the French customer €50, including 20% French VAT.

- You report the sale using OSS through the Estonian tax office.

- You pay the collected VAT to Estonia, which forwards it to France.

3. You use both non-EU and EU suppliers

- You may need: Both IOSS and OSS

Some larger dropshipping businesses mix both models.

For example:

- You dropship most products (< €150) from China (use IOSS).

- You store best-sellers in a Dutch warehouse for fast EU delivery (use OSS).

Yes, you can use both systems at the same time.

Just double-check that each transaction is reported under the correct scheme and never reported in both.

Do IOSS or OSS apply if I use a marketplace like Amazon or Etsy?

In many cases, no. When the marketplace qualifies as the deemed supplier, it takes responsibility for VAT collection and reporting.

Under EU VAT rules, platforms like Amazon, Etsy, or eBay are considered the supplier in two cases:

- Any sale by a seller outside the EU to a consumer inside the EU (including domestic sales or intra-EU distance or remote sales)

- European and non-European sellers selling imported goods to consumers at distance with consignments not exceeding €150

In both cases, the platform typically collects VAT at checkout and submits it to the tax authorities. You do not need your own IOSS or OSS registration for these specific transactions.

For example, Etsy and eBay use and submit their own IOSS numbers for qualifying low-value imports.

Whether the deemed supplier rule applies depends on whether the marketplace facilitates the transaction. This means the full checkout process takes place on the platform.

However, some obligations may still apply. For example, if you store inventory in an EU warehouse, you typically need to register for VAT in the country where the warehouse is located.

If you are unsure, check the VAT policy of the marketplace or consult your tax advisor.

How to stay VAT compliant as a dropshipper in 2025

By now, you understand what IOSS and OSS are and how they apply to your dropshipping business.

But the thing is: Understanding the rules isn’t enough. You also need to follow them consistently and correctly.

So, let’s cover the most important compliance steps:

1. Register for VAT

For IOSS (Import One-Stop Shop):

- If you’re a non-EU seller, you must register for IOSS through an EU-based intermediary (think of them like your tax representative in the EU).

- If you’re an EU seller, you can register for IOSS directly in your home country.

- You will receive a unique IOSS number. This number must be included in your shipping documentation so that customs knows VAT is already paid.

For OSS (One-Stop Shop):

- Register for OSS in your home country.

- Once registered, you can report all your EU cross-border B2C sales in a single quarterly return.

2. File and report VAT monthly or quarterly

Staying compliant means reporting on time, every time.

Here’s what you’ll need to do:

| Scheme | Reporting frequency | What you report |

| IOSS | Monthly | Total VAT collected on all imports under €150 |

| OSS | Quarterly | Total VAT on cross-border B2C sales within the EU |

- Returns must be filed electronically.

- You must pay the VAT owed by the deadline. No delays.

- Keep accurate records for at least 10 years (required by EU law).

Tip: You can use automated VAT tools or hire a VAT service provider to simplify this.

3. Invoicing and recordkeeping

Even if you use an automation tool, you’re still responsible for your compliance.

You must:

- Issue VAT-compliant invoices (when required by the customer or country).

- Store all transaction records, shipping documents, and VAT reports securely.

- Be ready to show these records during a VAT audit (yes, they do happen).

4. Avoid the common mistakes

Let’s talk about what not to do.

These are the most frequent errors that dropshippers make:

| ❌ Mistake | ✅ Solution |

| Using IOSS for orders above €150 | Only use IOSS for goods valued at €150 or less (excluding shipping/insurance) |

| Forgetting to include your IOSS number on customs forms | Make sure your supplier adds your IOSS number properly |

| Reporting sales twice in IOSS and OSS | Double-check which scheme applies to which transaction |

| Missing filing deadlines | Set reminders or automate your VAT returns with software |

| Using a bad VAT intermediary | Choose a licensed, experienced firm with EU tax knowledge |

Tools for staying VAT compliant when dropshipping

When it comes to staying VAT compliant in the EU, manually managing everything can be frustrating and slow.

That’s why there are tools available to help dropshippers like you.

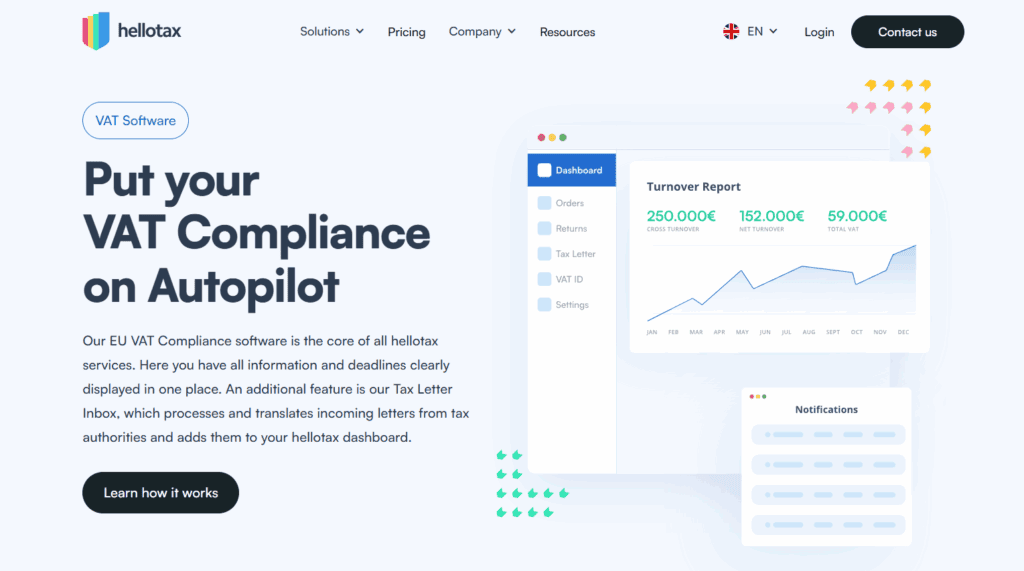

For example, hellotax.

hellotax is a VAT software platform combined with a team of real tax experts. It’s designed for online sellers who need to manage VAT across Europe, without hiring multiple accountants or struggling with spreadsheets.

If you’re using IOSS, hellotax can:

- Register you for IOSS, even if you’re a non-EU seller.

- Act as your EU intermediary (a legal requirement!).

- Collect and submit your monthly IOSS VAT returns.

- Help you include your IOSS number on customs paperwork to avoid delays.

Or, if you’re using OSS, hellotax makes this easy by:

- Handling Union OSS registration.

- Submitting your quarterly OSS returns.

- Tracking sales across EU countries and applying the correct VAT rates.

- Making sure your VAT is correctly paid to each country through a single return.

You can track your sales and VAT liabilities in real time through their dashboard:

And they even integrate with popular dropshipping platforms like Shopify:

If you’re interested, you can visit their website for more information here.

Summary

Before we go, we’ve created a quick summary of this article for you, so you can easily remember it:

- You must charge VAT correctly when selling to EU customers, based on each country’s rate.

- Use IOSS for low-value goods (under €150) shipped from outside the EU to EU consumers.

- Use OSS for sales within the EU when using an EU supplier.

- You can use both IOSS and OSS if your business involves both import and intra-EU sales.

- To stay compliant, register for the right scheme, file returns on time, and keep accurate records.

- Tools like hellotax can automate your VAT process, handle registrations and filings, and integrate with platforms like Shopify.

Conclusion

VAT compliance is one of the biggest challenges new dropshippers face when entering the EU market.

But it doesn’t have to be scary.

The IOSS and OSS systems are designed to simplify everything, from charging VAT correctly to filing returns.

If you choose the right setup and follow the rules, your store stays compliant, customers stay happy, and your business grows faster.

Now go put that knowledge to work and build a compliant, scalable, and successful dropshipping business in the EU!

Want to learn more about dropshipping?

Ready to move your dropshipping store to the next level? Check out the articles below:

Plus, don’t forget to check out our in-depth guide on how to start dropshipping here!